How to Use a Self-Directed IRA to Buy Investment Properties

How to Use a Self-Directed IRA to Buy Investment Properties

Unlock Greater Control and Higher Returns with Real Estate in Your Retirement Portfolio

Most people think of retirement accounts like IRAs and 401(k)s as stock-and-bond-only vehicles—but what if you could use those funds to invest in real estate, private lending, or even startups? Enter the Self-Directed IRA (SDIRA)—a powerful tool that allows you to take control of your retirement funds and direct them into non-traditional assets like investment properties.

Let’s break down how it works, what types of accounts can be used, and how savvy investors are using self-directed accounts to build wealth faster.

💼 What Types of Retirement Accounts Can Be Self-Directed?

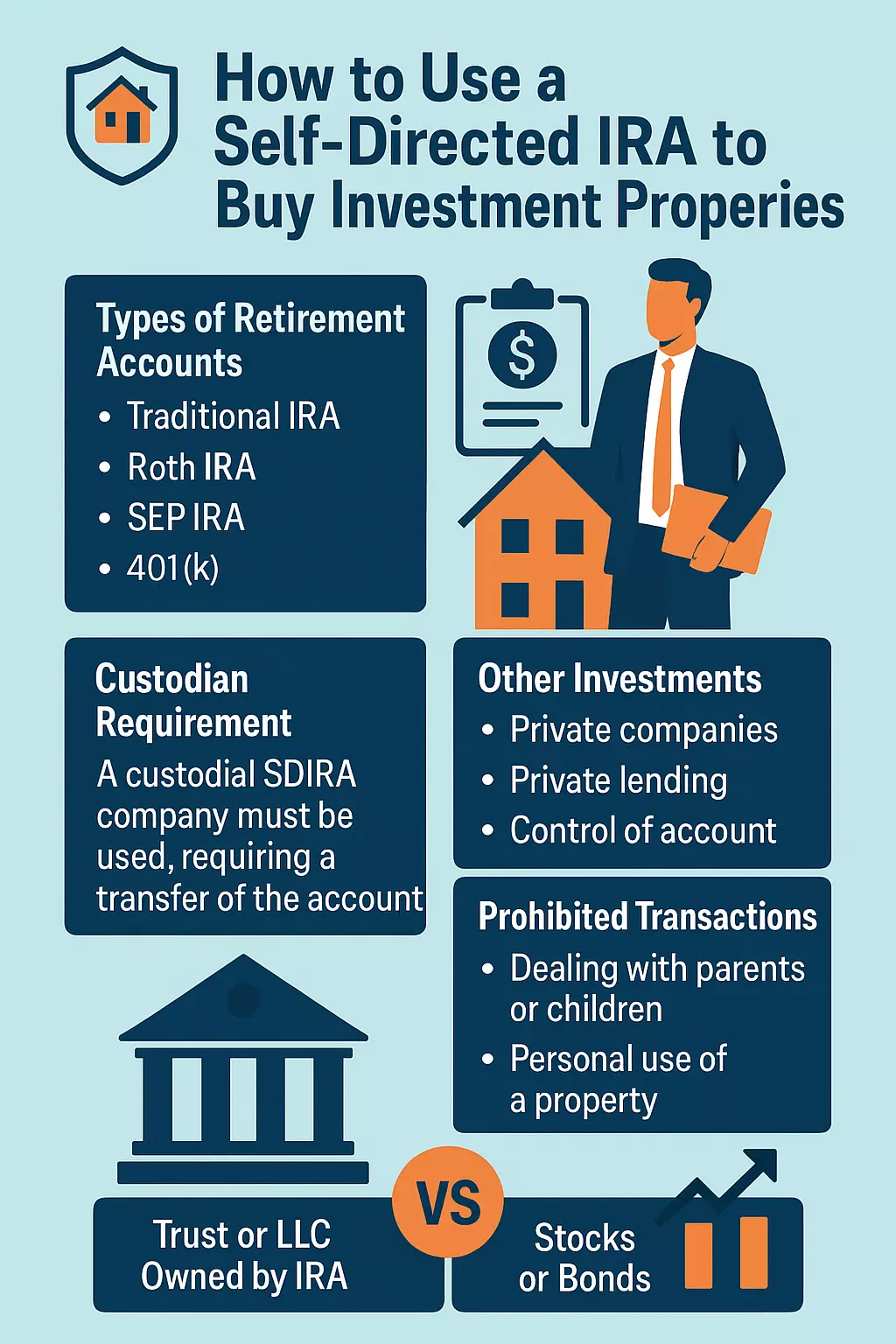

Many types of retirement accounts can be rolled over or opened in a self-directed format. These include:

-

Traditional IRA – Tax-deferred contributions and growth.

-

Roth IRA – Tax-free growth and withdrawals (subject to rules).

-

SEP IRA – Simplified Employee Pension accounts for self-employed individuals.

-

Solo 401(k) – Designed for self-employed individuals with no employees.

-

Traditional or Roth 401(k) – Some employer-sponsored accounts may be rolled over once you leave your employer.

👉 To invest in real estate, these accounts typically need to be transferred to a custodian that allows for self-direction. Most mainstream brokerages (like Fidelity, Vanguard, or Schwab) do not allow real estate or private investment transactions directly.

🏦 The Role of a Custodial SDIRA Company

To buy real estate or other alternative assets in your IRA, you’ll need a custodial company that specializes in self-directed retirement accounts. These custodians facilitate the legal structure and paperwork needed for compliance with IRS rules.

Popular SDIRA custodians include:

-

Equity Trust

-

Quest Trust

-

Advanta IRA

-

uDirect IRA Services

-

Directed IRA

You’ll transfer or rollover funds from your existing IRA, 401(k), or other qualifying plan into your new SDIRA account.

🧾 What Can You Invest In?

Self-directed IRAs open the door to a wide variety of alternative investments:

✅ Permitted Investments:

-

Rental properties (single-family, multifamily, commercial)

-

Fix-and-flip projects

-

Raw land or farmland

-

Private lending (secured by promissory notes or deeds)

-

Private equity/startups

-

Tax liens and deeds

-

Trust deeds

❌ Prohibited Transactions:

You cannot:

-

Buy or sell real estate to or from yourself, your spouse, parents, children, or their spouses.

-

Live in, vacation in, or personally benefit from the property.

-

Pay yourself to manage or repair the property.

In short, all transactions must be arms-length and purely for investment purposes.

🏗️ Using an LLC or Trust Owned by Your IRA

Many investors choose to set up a Checkbook Control LLC—an LLC that is wholly owned by the IRA. This allows you to write checks, make offers, and pay for expenses directly, without going through the custodian each time.

Another option is investing through a trust structure, which can also provide flexibility and legal benefits.

Always consult with a CPA or attorney experienced in SDIRA investing to structure it correctly.

📊 Example: Real Estate vs Traditional Investments

Let’s compare a few investment scenarios using $100,000 in a retirement account:

| Investment Type | Average Annual Return | 10-Year Value |

|---|---|---|

| S&P 500 Index Fund | ~8% | $215,892 |

| Bonds | ~3% | $134,392 |

| Rental Property (cash flow + appreciation) | ~12% | $310,585 |

| Fix-and-Flip (2 flips/year, $20k profit each) | ~20% | $619,173 |

| Private Lending (12% note, secured) | 12% | $310,585 |

📌 These are estimates—real returns vary based on location, experience, market conditions, and risk tolerance.

🔑 Key Benefits of Self-Directed IRAs for Real Estate

-

Diversification beyond the stock market

-

Tax-deferred or tax-free growth (Roth IRAs)

-

Access to higher returns through private deals

-

Full control of investment choices

-

Legacy planning and asset protection options

-

Ability to partner with other investors or entities

🚨 Caution: Work With Professionals

While the upside is significant, SDIRA investing comes with complex IRS rules. Mistakes can lead to penalties, taxes, or even disqualification of the entire account.

Work with:

-

A knowledgeable SDIRA custodian

-

A real estate-savvy CPA or tax advisor

-

A real estate attorney (especially for LLC structures)

🧠 Final Thoughts

If you’re an investor looking to supercharge your retirement account and break free from Wall Street’s limitations, a Self-Directed IRA could be the ticket. Whether it’s owning a rental, flipping properties, or lending money to fellow investors, your retirement dollars can work harder, smarter, and more flexibly.

Just be sure to follow the rules—and surround yourself with the right experts to guide you.

Ready to take control of your retirement investments? Let’s connect and explore how to get started with self-directed real estate deals.

Categories

- All Blogs (32)

- banking (7)

- building (1)

- buying (11)

- credit (4)

- development (1)

- finances (16)

- flipping (2)

- homebuyer (8)

- househacking (4)

- infinitebanking (1)

- insurance (1)

- investing (21)

- land (1)

- luxury (1)

- real estate (24)

- reit (1)

- renting (2)

- retirement (7)

- savings (3)

- secondhome (1)

- selfdirectedIRA (2)

- sellers (2)

- staging (1)

- taxes (1)

Recent Posts

GET MORE INFORMATION